child tax credit number

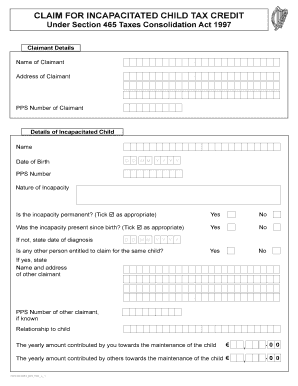

A dependent who doesnt have the required SSN may be eligible to be claimed for the credit for other dependents. Get help from HMRC.

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

The American Rescue Plan Act ARPA of 2021 expands.

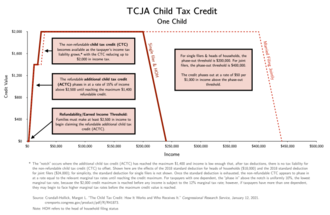

. In 2020 the two child poverty measures began to diverge due to the impact of large anti-poverty programs established or expanded in response to the COVID-19 pandemic such. The credit amount was increased for 2021. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

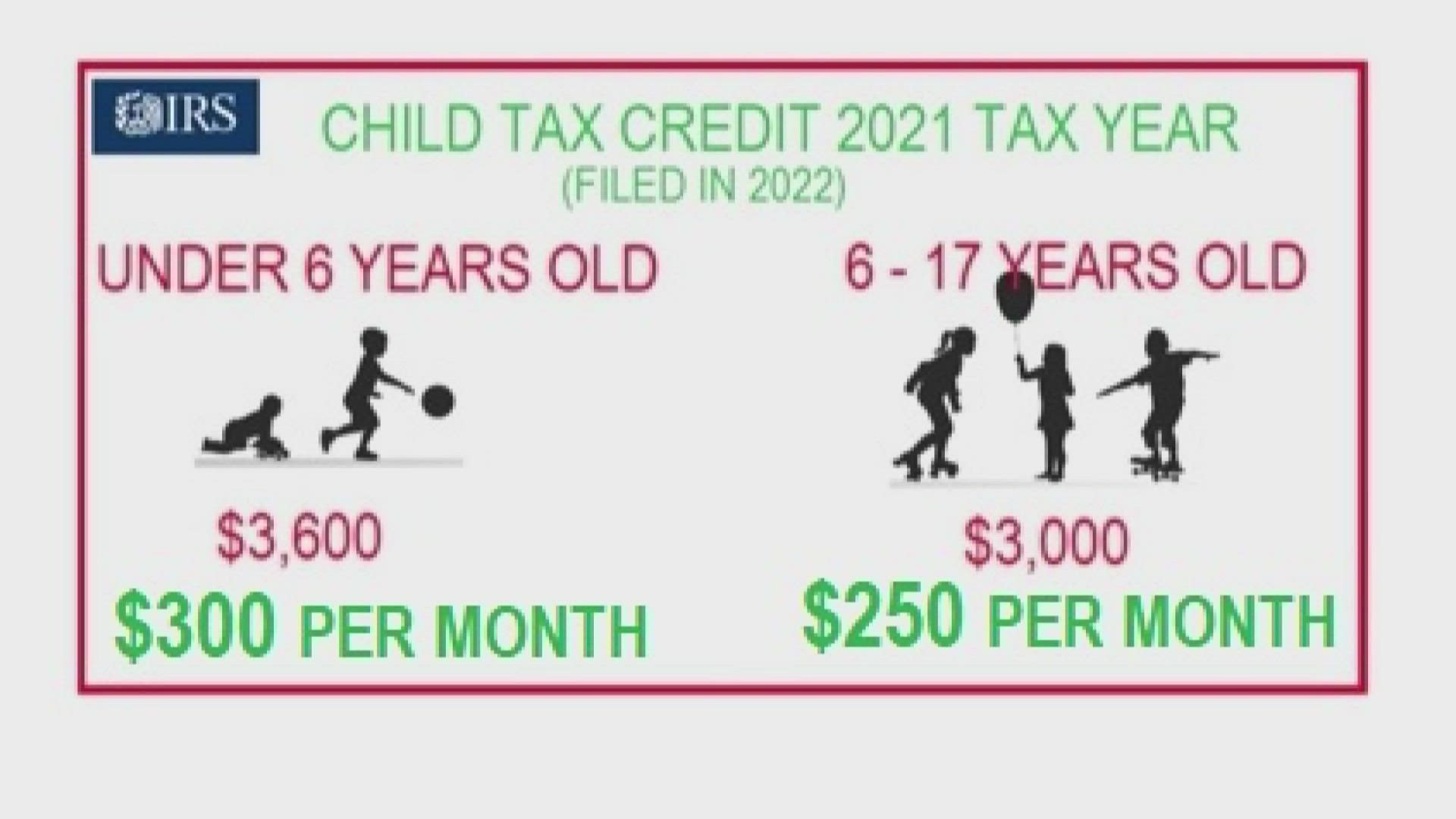

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child. Phone lines are usually less busy Tuesday to Thursday from 2pm to 4pm. Making a new claim for Child Tax Credit already claiming Child Tax Credit Child Tax Credit will not affect.

To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit CHILDCTC as monthly payments of 300 per child under age 6 and 250 per child between. There have been important changes to the Child Tax Credit that will help many families receive advance payments. Child Tax Credit Changes.

Your personal tax account or business tax account using HMRC online services Best time to call. 15 hours agoA growing number of Democrats are making a push to restore what President Biden once hoped would be his legacy. If your child is not a qualifying child for the Child Tax Credit you may be able to claim the 500 Credit for Other Dependents for that child when you file 2021 your tax return.

Make sure you have the following information on. Specifically the Child Tax Credit was revised in the following ways for 2021. For 2021 eligible parents or guardians can receive up to 3600 for each child who.

The Child Tax Credit will help all families succeed. Get your advance payments total and number of qualifying children in your online account. The number to try is 1-800-829-1040.

Only available if you arent required to file a 2021 tax return usually earning less than 12500 single or 25000 married File for the Child Tax Credit EITC and the 2021 stimulus payments. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. The amount you can get depends on how many children youve got and whether youre.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. Request for Transcript of Tax Return Form W-4.

Here are some numbers to know before claiming the child tax. For example if you call the IRS business phone number you wont get the answer youre looking for as the representatives at the end of the line. Employees Withholding Certificate.

Request for Taxpayer Identification Number TIN and Certification Form 4506-T. The American Rescue Plan increased the amount of the Child Tax. Similarly any children using an ITIN instead of a Social Security number cant be taken into account when an otherwise qualified individual claims the credit.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. You can use your username and password for the Child Tax Credit Update Portal to. A child tax credit that dramatically cuts poverty rates.

Telephone agents for the following benefits and credits are available.

Child Tax Credit Form Fill Online Printable Fillable Blank Pdffiller

What To Know About The First Advance Child Tax Credit Payment

Where Are The Most Child Tax Credits Claimed Tax Foundation

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit New Online Site Getctc Org 10tv Com

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit Did Not Come Today Issue Delaying Some Payments King5 Com

How Do I Contact Hmrc About Tax Credits Low Incomes Tax Reform Group

Rtc 2021 Child Tax Credit Advance

Treasury Irs Disperse Second Round Of Child Tax Payments

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

How The New Expanded Federal Child Tax Credit Will Work

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Arizona Families Now Getting Monthly Child Tax Credit Payments

How You Can Claim Up To 16k In Tax Credits For Child Care In 2021 What To Do First Mlive Com

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments